At a Glance

- Europe’s Medical Device Industry Workforce (2025–2030)

Europe’s medical device workforce comprises an estimated 865,000 professionals in 2025, spanning EU-27, the UK, Switzerland, and the broader EMEA MedTech manufacturing corridor. This represents roughly 27% of the region’s combined life sciences and healthcare technology labour base of ~3.2 million workers, reflecting Europe’s position as a global MedTech innovation and regulatory hub. - Europe’s concentration of MedTech talent is anchored by major clusters in Germany (Bavaria, Baden-Württemberg), France (Île-de-France, Auvergne-Rhône-Alpes), Ireland (Galway, Dublin), Switzerland (Zürich, Basel), the Netherlands (Eindhoven), and the Nordics, supported by strong R&D ecosystems, university–industry linkages, and established manufacturing networks.

- The workforce is expected to reach 985,000 professionals by 2030, growing at a 6% CAGR, driven by sustained demand for advanced diagnostics, implantable devices, robotics, minimally invasive surgical technologies, and rapidly scaling digital health and AI-enabled solutions.

- Europe’s workforce composition centres on four major skill clusters that collectively shape the region’s MedTech competitiveness and regulatory alignment.

- Engineering & R&D roles account for 37% of total headcount, spanning biomedical engineering, mechanical design, micro-electronics, mechatronics, materials engineering, and prototyping for high-regulation devices.

- Quality, Regulatory & Compliance professionals represent roughly 29%, driven by EU MDR/IVDR enforcement, heightened clinical evaluation requirements, rapid post-market surveillance expansion, and a rising need for regulatory science expertise.

- Manufacturing, Industrialisation & Process Engineering roles make up 23%, supported by Europe’s high-precision manufacturing base in orthopaedics, cardiovascular devices, in-vitro diagnostics, and sterile consumables, alongside reshoring and next-generation automation initiatives.

- Digital Health, Data & AI specialists comprise 11%, focusing on SaMD, digital therapeutics, connected care platforms, sensor integration, cybersecurity, clinical data pipelines, and compliance with the EU AI Act.

- Major demand drivers include MDR/IVDR regulatory strengthening, scaling adoption of minimally invasive and robotic solutions, investment in next-generation implants and imaging technologies, expansion of digital health and remote monitoring, and continued reshoring of critical MedTech manufacturing capacities across the EU-27 and UK.

Job Demand & Supply Dynamics

Europe’s medical device industry is experiencing widening demand–supply gaps across major MedTech hubs, with accelerating hiring needs driven by regulatory pressures, rapid digitalisation, and a pivot in manufacturing strategies. Job postings for engineering, quality, regulatory, and digital health have grown by 32–48% between 2021 and 2024 across Germany, France, Ireland, Switzerland, and the Nordics, reflecting sustained investments in R&D, advanced diagnostics, robotics, and readiness for EU MDR/IVDR compliance.

The most sought-after professionals include biomedical engineers, regulatory affairs professionals, clinical evaluation experts, process validation engineers, developers of software as a medical device, cybersecurity engineers, and data scientists with deep expertise in medical AI and connected care systems.

On the supply side, more than 1.95 million STEM graduates are produced by Europe every year, with only 14–17% going into the combined MedTech, biotech, and life sciences manufacturing ecosystem. This amounts to an estimated inflow of 270,000–320,000 MedTech-relevant yearly graduates, which is less than the needs of industry hiring, at more than 350,000–390,000 new or replacement roles per year in the EU-27, UK, and Switzerland.

The consequent gap—30,000–60,000 professionals per year—is most pronounced in regulatory science, quality systems, embedded software, medical AI, and precision engineering. These shortages significantly extend the time that job vacancies can be open, with 4–7 months for regulatory and clinical positions, and 6–10 months for advanced R&D, AI/ML, and SaMD engineering positions. That affects time to market and compliance readiness across Europe's MedTech ecosystem.

Salary Benchmarking

Europe’s medical device industry is experiencing steady upward salary progression as MDR/IVDR compliance, MedTech digitisation, robotics adoption, and increasing demand for AI-enabled devices correspond to steady upward salary progression in Europe's leading clusters in Germany, France, Ireland, Switzerland, the Netherlands, and the Nordics. In key engineering, regulatory, and quality posts, a 10-22% premium versus general life sciences and advanced manufacturing is observed.

The main areas of dramatic increases relate to regulatory science, software/embedded engineering, and clinical evaluation. It is among senior professionals with technical documentation, design control, validation, and development of connected devices that the highest year-over-year wage acceleration is seen, as companies compete for common talent with pharma, diagnostics, digital health, and robotics.

Salary inflation has remained most pronounced in the high-cost, innovation-centric clusters of Switzerland, Ireland, Germany, and the Nordics, where compensation expectations continue to be pushed upward by the scarcity of advanced digital and regulatory skills.

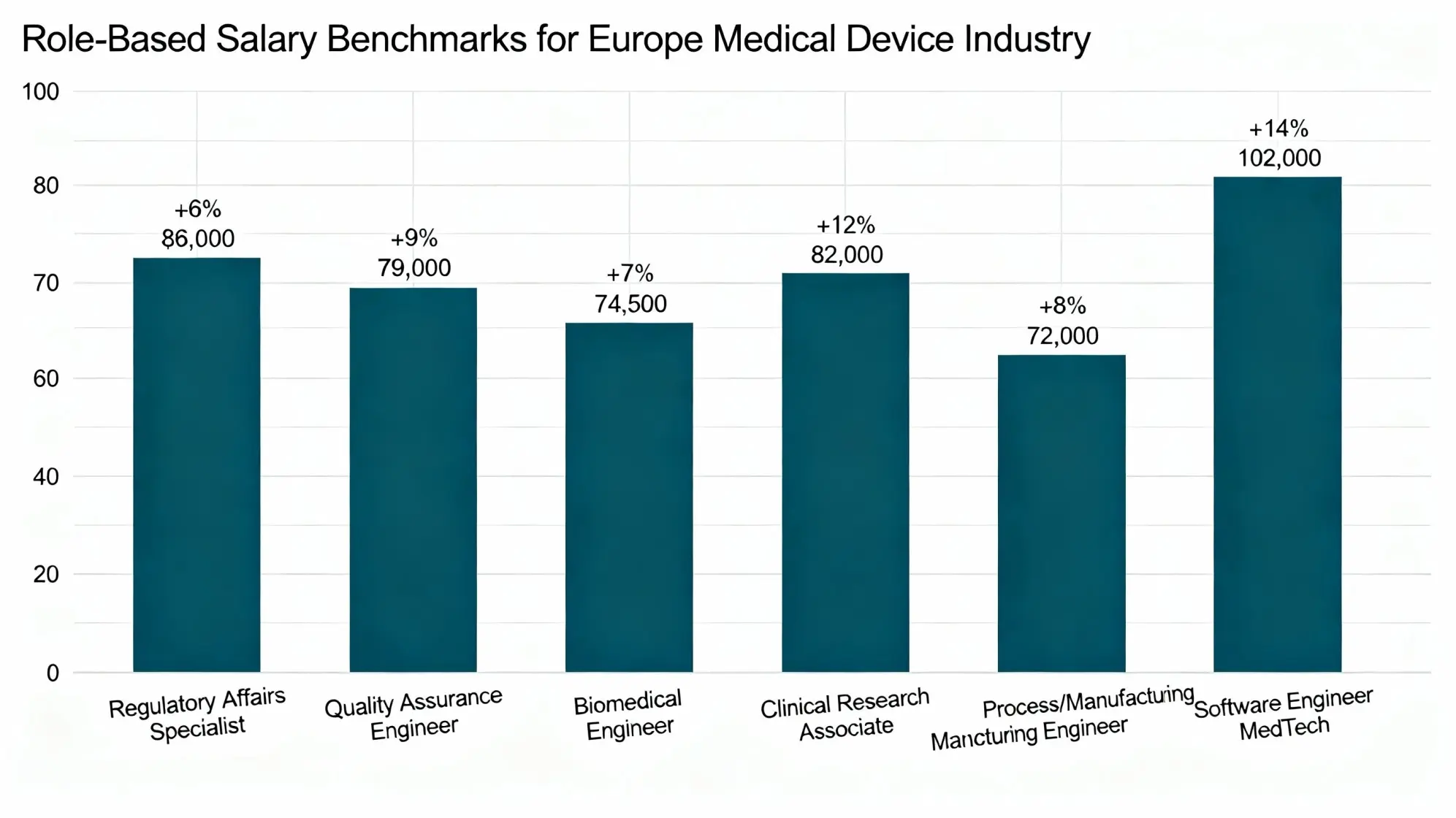

Role-Based Salary Benchmarks — Europe Medical Device Industry (Annual, USD Equivalent)

| Role | Median Salary (USD) | YoY % Change | Comments |

| Regulatory Affairs Specialist | $86,000 | +11% | MDR/IVDR & EU AI Act expertise driving premiums |

| Quality Assurance Engineer | $79,000 | +9% | ISO 13485, CAPA, and risk management shortages |

| Biomedical Engineer | $74,500 | +7% | Demand rising in implants, MIS, diagnostics, and wearables |

| Clinical Research Associate | $82,000 | +10% | Expansion in clinical evidence, PMS, and real-world data |

| Process / Manufacturing Engineer | $72,000 | +6% | Precision engineering + automation talent gaps |

| Software Engineer (MedTech) | $102,000 | +14% | Scarcity across SaMD, embedded systems, cybersecurity & medical AI |

Geographic variation remains substantial. Switzerland and Ireland offer the highest compensation—usually 20-35% over EU averages, due to intense R&D clusters and headquarters for many multinational MedTech companies. Strong engineering ecosystems and advanced manufacturing prop up salaries 10-18% above EU averages in Germany, the Netherlands, and the Nordics. Low-salary bases but above-average growth in pay can be seen in Eastern and Southern Europe as manufacturing, digital-health engineering, and regulatory operations expand. Retention incentives-skill-based bonuses, flexibility regarding hybrid work, relocation allowances, and annual performance bonuses of 6-12%-have increasingly become the norm throughout Europe amidst chronic shortages of regulatory, digital, and senior R&D talent.

HR Challenges & Organisational Demands

Europe’s medical device industry is navigating mounting human-capital pressure on the European medical device industry, upending organisational models in the EU-27, UK, and Switzerland. Traditionally, engineering-centric organisations struggle to integrate software-first, data-heavy, and cross-functional workflows required by robotics, SaMD, connected devices, and digital therapeutics. Talent shortages are most severe for regulatory affairs, clinical evaluation, post-market surveillance, embedded software, cybersecurity, and AI/ML for medical applications, increasingly shared across pharmaceuticals, diagnostics, and digital-health competitors, a factor that heightens attrition risks in mid-senior technical talent.

The adoption of hybrid and distributed work further adds to the complication. While software engineering, documentation, data analysis, and regulatory operations can adapt with quite smooth fluidity to remote models, high-precision manufacturing, cleanroom operations, process validation, and test engineering need to be performed on site. This split workforce model further complicates HR policy design, GMP alignment, and audit preparedness for the teams producing MDR/IVDR documentation and managing traceability, vigilance, and risk-management processes.

The leaders in organisations must start moving toward structures that are more digitally integrated, compliance-aware, and collaborative. In the present scenario, HR teams are increasingly expected to deploy workforce analytics, predict any future skill shortages, establish EU-compliant reskilling pathways, and support transformation in areas relating to automation, digital health, and emerging AI-enabled

Future-Oriented Roles & Skills (2030 Horizon)

Europe’s medical device industry is on track to shift decisively toward AI-enabled, software-driven, and automation-intensive innovation by 2030, reshaping talent needs across the EU-27, UK, and Switzerland. AI-Driven Diagnostics & Intelligent Device Engineers will play a pivotal role as machine learning becomes embedded in imaging platforms, cardiovascular systems, implantable devices, and remote patient-monitoring tools. These devices will merge biomedical engineering with algorithm development, clinical evidence evaluation, and real-world data modelling according to EU AI Act requirements. Similarly, there will also be a complementary rise in prominence of Regulatory Tech & Compliance Automation Specialists because MDR/IVDR documentation, clinical evaluation reporting, and PMS workflows are rapidly moving toward digitalised, machine-readable formats supported by automation and NLP-driven quality systems.

As adoption of connected care accelerates across Europe, Medical Device Cybersecurity, Firmware Integrity & Interoperability Engineers will be key in embedded software, hospital-IoT ecosystems, and cloud-linked MedTech platforms. Human Factors & Usability Engineers will find themselves indispensable in next-generation surgical robotics, SaMD interfaces, and patient-facing diagnostic solutions. In manufacturing, the Digital Manufacturing & Smart-Factory Systems Architects will drive robotics, real-time quality analytics, and predictive maintenance in highly regulated environments.

By 2030, the leading edge of MedTech in Europe will be defined by four skill domains: advanced AI/ML integration, digital regulatory automation, cybersecurity and resilience of embedded systems, and human-machine collaboration to drive next-generation device innovation.

Macroeconomic & Investment Outlook

Europe’s medical device industry operates within a stable yet increasingly innovation-driven by modest growth in GDP, continued healthcare digitalisation, and growing investment in MedTech across the EU-27, UK, and Switzerland. According to the European Commission, the EU's annual GDP growth is likely to be between 1.2 and 1.6% through 2026, underpinned by industrial modernisation, expanded digital health, and strategic funding of technologies under EU-wide programs. Healthcare expenditure is rising against a backdrop of demographic pressures, increasing chronic disease prevalence, and accelerating hospital digitalisation to 10–11% of GDP among major economies, with demand for diagnostic, minimally invasive, and connected-care infrastructure.

The investment climate in Europe remains very supportive of the advancement of MedTech. Programs such as Horizon Europe, the EU Chips Act, Digital Europe, and national innovation funds within Germany, France, Ireland, and the Nordics continue to channel capital toward robotics, AI-enabled medical systems, cybersecurity, smart manufacturing, and regulatory digitalisation. Specifically, in Europe, investment in MedTech has increased by 9-12% in 2023-2024, with particular strong momentum in cleanroom automation, imaging systems, wearable sensors, and SaMD development ecosystems. This will likely continue to drive the creation of 120,000 to 160,000 new jobs within MedTech by 2030 in focused areas including AI engineering, regulatory science, advanced manufacturing, and digital health.

Structural challenges persist: rising energy costs, supply-chain dependencies, MDR/IVDR compliance burden, and region-wide talent shortages have made the case for resilient industrial policies and long-term innovation capacity.

Skillset Analysis

Europe’s medical device skills landscape is shaped by a multi-tier competency structure driven by the EU's tough regulatory frameworks, fast digital-health growth, and the mature precision-engineering base of the region. Core MedTech engineering capabilities at the most fundamental level include biomedical design, mechanical and mechatronics engineering, electronics for therapeutic and diagnostic systems, materials science, and GMP-aligned cleanroom manufacturing. These skill sets draw from strong industrial clusters within Germany, Ireland, Switzerland, France, and the Netherlands that produce high-precision implants, surgical robotics components, imaging hardware, and diagnostics platforms.

The second tier of competencies is built around regulatory, quality, and clinical compliance expertise. Deep proficiency in EU MDR/IVDR, ISO 13485, usability engineering, risk management, clinical evaluation, process validation, and post-market surveillance is incredibly important as Europe moves to more evidence-driven and documentation-heavy regulatory oversight. Mid-senior positions increasingly require cross-functional literacy with regard to vigilance systems, real-world evidence, and regulatory digitalisation.

The third tier is Europe's rapid acceleration in digital transformation. Among the fastest-expanding skill sets, one finds necessary competencies in the development of SaMD, embedded software, AI/ML for imaging and cardiology, cybersecurity, and interoperability standards like FHIR/HL7, clinical data engineering, and human-factors design. New frontier skills like digital twin simulation, robotics-driven manufacturing, model explainability for high-risk AI systems, and secure-by-design firmware have emerged across European universities, innovation hubs, and multinational R&D centres, signalling the rise of next-generation MedTech innovation.

Talent Migration Patterns

Europe’s medical device industry is experiencing increasingly dynamic talent migration flows shaped by growing digital health ecosystems, advances in manufacturing, and sustained high-skill technical labour supply gaps. Inbound international flows are most pronounced across senior biomedical engineering, regulatory science, clinical evaluation, AI/ML engineering, and cybersecurity-skilled positions, where domestic supply remains inadequate across the EU-27, the UK, and Switzerland. A rising number of professionals from India, China, the United States, Southeast Asia, and Latin America is moving into the MedTech hubs of Germany, Ireland, Switzerland, the Netherlands, France, and the Nordics, driven by strong R&D intensity, competitive compensation packages, and structured EU career pathways for professionals.

Intra-EU mobility remains one of the biggest drivers of workforce replenishment. Talent in Eastern and Southern Europe, especially from Romania, Poland, Portugal, Greece, and Croatia, tends to move into the value-added MedTech clusters due to the better availability of jobs in diagnostics, surgical robotics, implantables, and digital health engineering. Outbound migration, even among European AI specialists, software engineers, and regulatory leaders, continues to be remarkable, especially with more lucrative prospects opening up for them in the United States, the UK, and Switzerland.

Currently, foreign-born professionals make up 20-28% of the MedTech workforce in Europe, as high as 35-40% in software, AI/ML, cybersecurity, and regulatory documentation. In pursuit of sustainability for such innovation, Europe is scaling skilled-migration policies, digital-skills academies, cross-border R&D fellowships, and targeted AI and regulatory-science training programs with a view to reducing long-term dependency on external talent by ensuring strong domestic capability pipelines.

University & Academic Pipeline

Europe’s medical device talent pipeline is anchored by a diverse network of universities, polytechnic institutes, and medical research centres, though alignment with rapidly evolving digital, regulatory, and AI-driven MedTech skills remains uneven across the region. Leading institutions include ETH Zurich, TU Munich, KU Leuven, Imperial College London, Delft University of Technology, University of Oxford, and Karolinska Institute, graduating a substantial share of biomedical engineers, mechanical designers, materials scientists, clinical researchers, and early-career regulatory professionals entering the workforce in MedTech.

Polytechnics and applied science universities in Germany, Ireland, France, and the Netherlands are important sources of talent in manufacturing engineering, quality assurance, automation, and cleanroom operations that underpin Europe's high-precision MedTech production capacity. It is estimated that 68-72% of new entrants into MedTech across the region have STEM degrees, with dominant academic routes in biomedical engineering, electronics, mechatronics, computer science, biotechnology, and data science.

However, there are still very few focused academic programs in SaMD engineering, AI/ML for diagnostics, cybersecurity of connected devices, smart-factory systems, and MDR/IVDR regulatory science, with capability gaps remaining. Europe is continuing to develop its dual-education pathways, industry-linked R&D apprenticeships, and EU-funded programs under Horizon Europe and Digital Europe, targeting the update of education and training. These will help build the digital, regulatory, and advanced engineering competencies required to underpin the future pipeline of MedTech innovation in Europe.

Largest Hiring Companies & Competitive Landscape

Europe’s medical device industry is shaped by a diverse mix of global MedTech leaders, regional manufacturing champions, and a fast-growing digital health and diagnostics ecosystem that sets up a very competitive talent environment across the EU-27, the UK, and Switzerland. Major multinational employers such as Medtronic, Philips, Siemens Healthineers, GE HealthCare, Stryker, Zimmer Biomet, Roche Diagnostics, Abbott, and Johnson & Johnson have established significant R&D, engineering, and manufacturing centres in Germany, Ireland, Switzerland, the Netherlands, and the Nordics. These companies together employ tens of thousands of professionals in biomedical engineering, regulatory affairs, clinical operations, software, and advanced manufacturing.

Equally influential in this respect are precision engineering and device manufacturing clusters in Europe, specifically the orthopaedics and cardiovascular devices, imaging hardware, and diagnostics hubs in Germany's Tuttlingen, Ireland's Galway, Lausanne-Zürich in Switzerland, Lyon-Grenoble in France, and Eindhoven in the Netherlands. Driving these hubs are firms like Edwards Lifesciences, Straumann, Getinge, Dräger, Fresenius, Philips IGT, and hundreds of specialised SMEs that are driving continuous demand for process engineers, automation specialists, quality managers, and materials engineers.

The competition has grown fiercer, with an ever-increasing share of Europe's digital health and AI-driven diagnostics market. In general, fast-moving players such as Babylon, Ada Health, Corti, Owlytics, Biofourmis, and many other EU-funded SaMD startups are adding more AI engineers, cybersecurity experts, and data scientists to their payroll. Midsized manufacturers, accounting for more than 80% of Europe's MedTech, are expanding university partnerships and pan-European R&D collaborations to keep pace with the multinational hiring scale.

Location Analysis

Europe’s medical device workforce exhibits strong regional clustering, driven by concentrated manufacturing capacity, deep regulatory expertise, and expanding digital health and AI ecosystems. Germany remains the largest and most diversified hub, with Bavaria and Baden-Württemberg hosting more than 145,000 professionals and 4,200 active vacancies combined, yielding a 34.5:1 supply ratio and average 73-day vacancy duration, reflecting fierce competition for regulatory, R&D, embedded software, and AI talent. The workforce in German MedTech is growing at a 4.2% CAGR, supported by robotics, imaging, and surgical technology expansion.

Ireland is one of the fastest-growing MedTech hubs in Europe, with 56,000 specialists employed, 1,520 live vacancies, and a supply ratio of 36.8:1. The vacancy duration currently stands at an average of 59 days, supported by excellent alignment between university and industry. Demand is being led by validation, manufacturing engineering, quality systems, and device automation.

Switzerland has 48,500 professionals in the workforce and 1,180 vacancies, giving it a supply ratio of 41.0:1 and an average vacancy duration of 61 days. Specialisation in diagnostics, implants, and high-precision devices drives the pace, with a 5.4% CAGR; high skill requirements boost hiring intensity.

Supported by growing imaging, cardiovascular devices, and digital health platforms, the Netherlands has an ecosystem that encompasses 33,800 professionals, 820 vacancies, and a supply-to-demand ratio of 41.2:1. This is consistent with an average vacancy duration of 55 days, pointing to effective recruitment pipelines and quality technical universities.

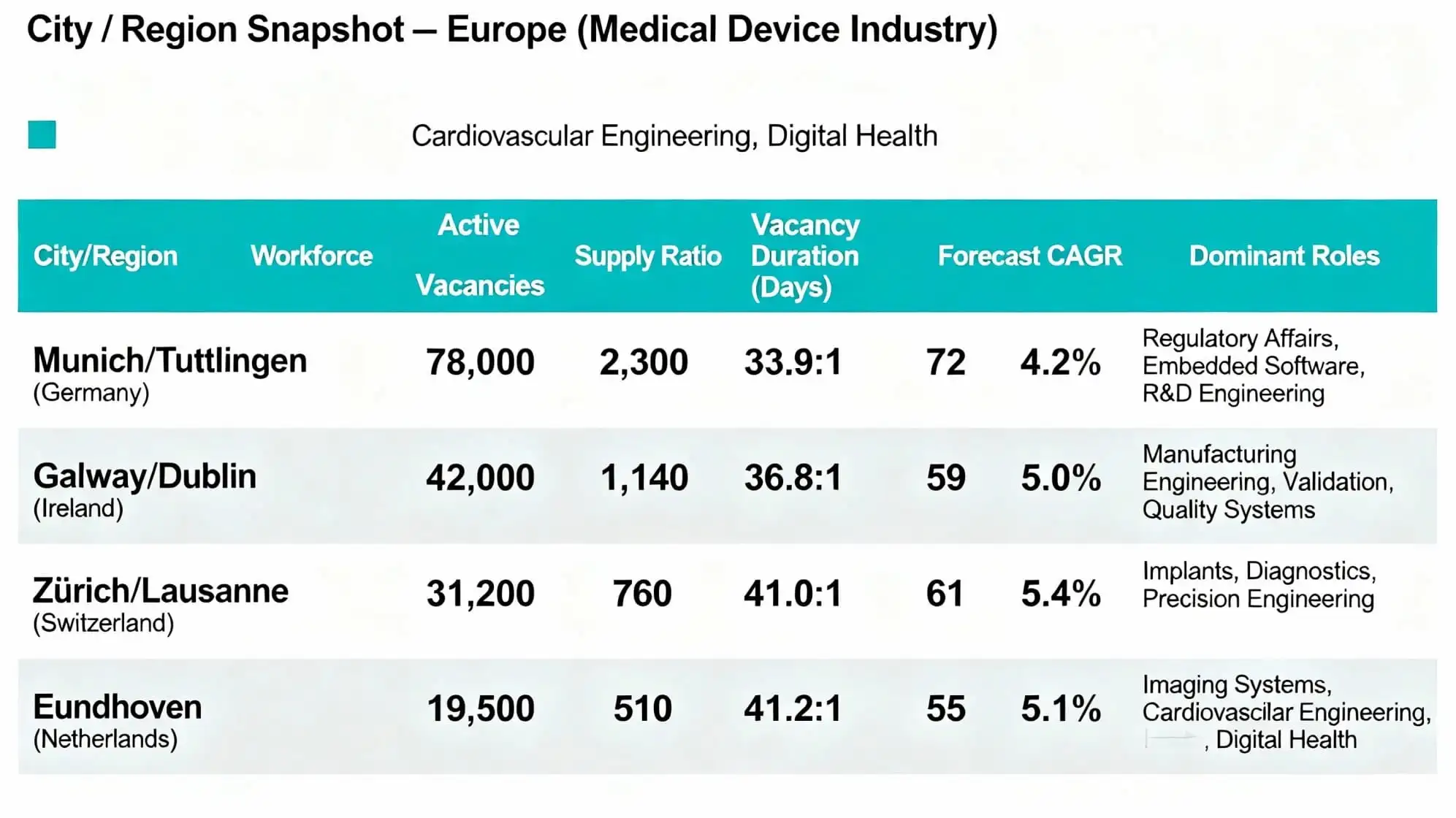

City / Region Snapshot — Europe (Medical Device Industry)

| City / Region |

Workforce |

Active Vacancies | Supply Ratio | Vacancy Duration (Days) | Forecast CAGR | Dominant Roles |

| Munich / Tuttlingen (Germany) | 78,000 | 2,300 | 33.9:1 | 72 | 4.2% | Regulatory Affairs, Embedded Software, R&D Engineering |

| Galway / Dublin (Ireland) | 42,000 | 1,140 | 36.8:1 | 59 | 5.0% | Manufacturing Engineering, Validation, Quality Systems |

| Zürich / Lausanne (Switzerland) | 31,200 | 760 | 41.0:1 | 61 | 5.4% | Implants, Diagnostics, Precision Engineering |

| Eindhoven (Netherlands) | 19,500 | 510 | 41.2:1 | 55 | 5.1% | Imaging Systems, Cardiovascular Engineering, Digital Health |

Demand Pressure — Europe (Medical Device Sector)

Europe’s medical device industry is experiencing sustained and escalating demand pressure across engineering, regulatory, digital-health, and advanced manufacturing functions, underpinned by the implementation of MDR/IVDR, fast MedTech digitalisation, and expanding world exports. Unsurprisingly, talent supplies rarely keep pace with employer demands, and job postings for regulatory, software, and engineering positions are up 30-45% since 2021 in major hubs like Germany, Ireland, Switzerland, France, and the Netherlands. Employer demand outpaces candidate supply across all skills in question; the most pronounced shortages appear to be in regulatory affairs, quality systems, clinical evaluation, embedded software, cybersecurity, AI/ML engineering, interoperability-HL7/FHIR, and data engineering, with a ratio of employer demand to candidate supply of 2.6–4.1:1 based on regional labour insights from CEDEFOP and Eurostat.

The MDR/IVDR timelines continue to amplify hiring pressure, with manufacturers scaling up documentation-heavy requirements across risk management, PMS, clinical evidence, and Notified Body audit readiness. At the same time, the rapid proliferation of SaMD, imaging AI, digital therapeutics, telemonitoring, and smart-factory automation has sharply increased demand for software engineers, medical-AI specialists, cloud-integration developers, and cyber-secure firmware engineers.

Competition is reinforced by regional clustering. Demand ratios reach up to 4.0–4.7:1 for senior R&D, regulatory, and digital positions in Bavaria, Baden-Württemberg, Galway, Zürich–Lausanne, and Eindhoven—Europe's core MedTech hubs. Furthermore, Europe faces external competition from the U.S., the UK, and the Asia-Pacific for the same small pools of digital, regulatory, and AI talent, putting more pressure on hiring in Europe.

Coverage

Geographic Scope — Europe

This analysis focuses on Europe’s medical device workforce across the region’s major MedTech innovation and manufacturing hubs. The geographic scope includes Germany—with Bavaria and Baden-Württemberg serving as Europe’s largest clusters for surgical technology, imaging systems, and precision engineering—as well as Ireland, anchored by Galway and Dublin’s multinational-led manufacturing and R&D ecosystem. Switzerland's Zürich-Lausanne corridor and the Netherlands' Eindhoven region, which are high-density hubs for diagnostics, cardiovascular devices, and digital-health innovation; France's Île-de-France and Auvergne-Rhône-Alpes regions, which contribute deep pools of regulatory, R&D, and clinical talent; and smaller, though rapidly expanding, centres in the Nordics, Belgium, and Spain, which expand capacity in SaMD, AI-enabled diagnostics, and advanced manufacturing. Europe is the second-largest market for MedTech in the world, and also hosts many of the world's global regulatory bodies and manufacturing clusters; therefore, workforce trends across the region have impacts on global competitiveness within MedTech.

Industry Scope — Medical Devices & Digital Health

The scope covers Europe’s traditional medical device manufacturing base, high-precision engineering, diagnostics and imaging, implantable devices, robotics, surgical systems, and the rapidly expanding digital-health ecosystem. This ranges from OEMs and contract manufacturers to regulatory consultancies, notified bodies, SaMD developers, AI-driven diagnostics firms, and MedTech-focused digital startups. The strong SME landscape within Europe, especially in Germany, France, the Netherlands, Ireland, and Switzerland, forms the backbone for the region's supply chain.

Role Coverage — Top 30 MedTech Roles

The assessment examines thirty critical competencies associated with R&D engineering, regulatory affairs, quality management, clinical research, digital health, & SaMD software development, cybersecurity, manufacturing engineering, AI/ML modelling, and data-driven device innovation, which form the basis of compliance with MDR/IVDR, Clinical Evidence Generation, and next-generation device development across Europe's MedTech ecosystem.

Analytical Horizon — 2025–2030

The timeframe analyses Europe’s MedTech workforce transformation through 2030, capturing the impact of MDR/IVDR implementation, rapid digitalisation, automation-driven manufacturing upgrades, and accelerating investment in AI-enabled diagnostics, robotics, and smart medical systems that are changing talent demand across the continent.